-

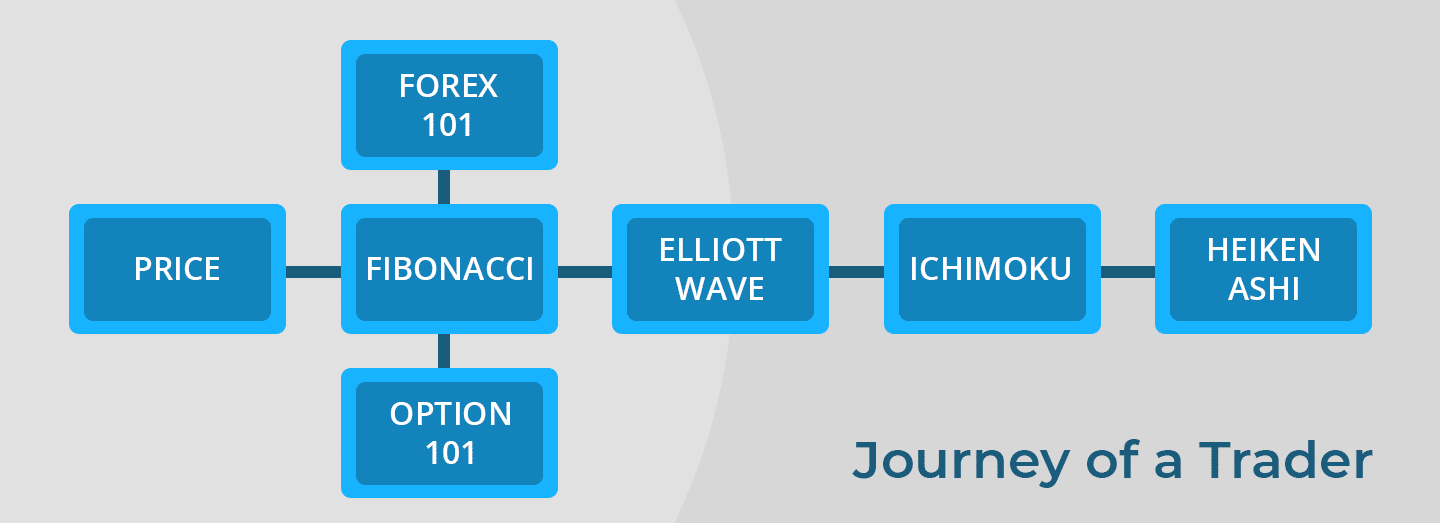

Fibonacci

-

Elliott Wave

-

Ichimoku

-

Heikin-Ashi

-

Forex 101

-

Option 101

This program starts out with detailed trading analysis of all the fibonacci ratios including extensions and retracements. We examine which Fibonacci levels that are the best to use, and we will analyze these levels with real time trades. We are going to show you how to use risk analysis, and how to set entries and stops using the various Fibo Ratios.

You will also get a full walkthough of Fibonacci clustering, and we will show you clustering across multiple time frames, and how use this to your benefit in your trading plan. We will also show you our trading plan and Advanced Fibo Trading. Here is a video on what about the workshop:

This program will shows how Elliott wave is an extension of Fibonacci analysis. We will review all waves and the corrective waves of Elliott Wave Analysis in depth. We will review the rules used in dissecting Waves 1-5. We will be comparing and contrasting Elliott Waves Vs Fibonacci Levels and how to incorporate the two together. We will review the problems that exist with Elliott Waves and solve them. We will take you through Multiple time frame trading of the waves and how to use this will real trading examples. We will go through in depth multiple trading strategies for Elliott Waves reviewing entries, exits with legging out, and how do to do your risk analysis & money management with these plans.

This course includes the Ichimoku E-Book written by Manesh Patel and also includes a 2 hour recorded video course. This course will cover how to use, understand and trade with the Ichimoku cloud indicator. You will learn how to determine market sentiment which should enable you to make more accurate trading decisions. The course covers the background on how the Ichimoku Cloud Indicators work across all markets and time frames including, Equities, Futures and Forex. Some of the main topics covered in this course are:

Ichimoku Cloud Components

Ichimoku Cloud Internet Myths

Trend Trading

This program teaches how to interpret Heikin Ashi Candles using real time trading analysis. We will review the formulas for Heikin Ashi and we will walk through multiple trading strategies showing how to enter, how to exit, and how to optimize your trades using Heikin Ashi Candles. We wil go across multiple time frames and incorporate money management and risk analysis within our trading strategies. More information can be found here: www.heiken-ashi.com

We will start out with the Forex Basics like: What is a pip? What is a currency pair? and How to read a Forex Chart. This course is designed for the Forex beginner. Once you’ve mastered this course you will be all set to understand forex trading and possibly move on to live trading. Please Note: This workshop will go through both fundamental and technical analysis. .

In this two hour course you will learn all the basics of options and move into understanding how to use the basics to trade Options Strategies. Also, learn how to create and understand a risk graph for Calls, Puts and all options strategies. You will learn how to analyze maximum risk and maximum profits for each type of trade set-up. Included in this course is understanding what makes up Unusual Options Activity. You will learn to understand how to scan for Unusual Options Activity in real time with Think or Swim. Also, learn to determine potentially the best entry and exit points for all of these different options strategies.